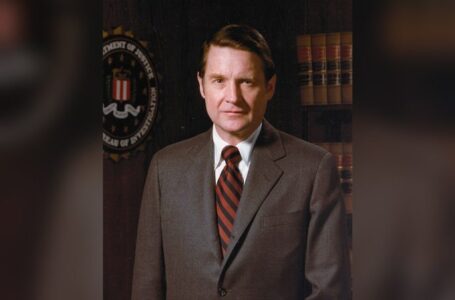

Former FBI and CIA chief urges senators to sink Patel, Gabbard

3 Cryptocurrencies Set to Soar Post-2024 Bitcoin Halving

Ethereum, Litecoin, and Bitcoin Minetrix stand out as cryptocurrencies likely to surge after Bitcoin’s 2024 halving event. Image by Muhammad Irfan, Adobe Stock.

March 2024 will mark a monumental event for Bitcoin—the fourth halving in its history. This preprogrammed supply shock has proven to be a catalyst for explosive growth in the past. After previous halvings, Bitcoin went on epic bull runs that minted millionaires—many who had the foresight to hold BTC through halvings reaped fortunes in the months after.

Following the first halving in 2012, the major cryptocurrency surged over 8000%. Then in 2017 after the second halving, Bitcoin’s price skyrocketed from under $1000 to nearly $20,000 in a matter of months.

With BTC’s built-in monetary policy set to constrain supply again this March, the BTC price is expected by many to soar to new all-time highs. But Bitcoin may not be the only winner—other select cryptocurrencies have shown even stronger upside in the past when Bitcoin’s halvings occur.

Their blockchain fundamentals and correlations to Bitcoin price action strategically position these some crypto gems to potentially capitalize on the upcoming supply shock. Analyzing historical data and projecting future trends suggests three cryptocurrencies—Ethereum, Litecoin, and Bitcoin Minetrix—could post outsized returns leading up to and/or after March 2024’s halving event.

Visit Bitcoin Minetrix Here

Ethereum: The Dominant Smart Contract Platform

As the second-largest cryptocurrency behind Bitcoin, Ethereum has firmly established itself as the leading smart contract platform. Launched in 2015, Ethereum introduced the ability to create and execute decentralized applications and self-executing smart contracts on its blockchain. This opened up a world of possibilities for blockchain-based financial services, games, collectibles, and more through the rise of decentralized finance (DeFi).

Ethereum’s native token, Ether (ETH), has seen exponential growth in price and adoption alongside the expansion of apps built on Ethereum. According to DefiLlama, the total value locked in Ethereum surpassed $30.58 billion in 2024, highlighting the surging utility and demand for ETH.

This time is different for Ethereum.

During the previous Bitcoin halving cycle, ETH completely collapsed against BTC in the middle of the bear market.

But this third halving cycle is coming to an end and ETH is still up more than 200% against BTC. pic.twitter.com/1EqnUCPH7Q

— ecoinometrics (@ecoinometrics) January 23, 2024

Ethereum’s performance around Bitcoin’s halving events provides clues into its potential future price action. In the 2020 halving, ETH gained 31.8% in the month prior and then surged 88.6% in the 3 months after. Ethereum seems to be amplifying Bitcoin’s bull runs more over time.

Multiple factors support this ramping up of Ethereum’s bullish momentum around Bitcoin halvings. For one, the maturity and adoption of the Ethereum network continue to accelerate. In 2020, Ethereum on average settled 500,000 daily transactions, and in 2023, the average daily transactions on Ethereum was more than 1,000,000. The growth of DeFi and NFTs built on Ethereum will likely keep demand for ETH surging.

Ethereum’s upcoming Dencun upgrade is another catalyst on the horizon. This upgrade will make the network more scalable and sustainable.

Given its established dominance and wave of impactful upgrades, Ethereum seems primed to capitalize on the next Bitcoin halving event. The data shows its returns may even outperform Bitcoin’s gains if past halving patterns hold.

Could Bitcoin’s Faster Sibling Litecoin Shine Post-Halving?

Created in 2011 as a faster alternative, Litecoin shares much in common with Bitcoin while improving on its speed. Litecoin’s developers decreased the block mining time from Bitcoin’s 10 minutes down to just 2.5 minutes, enabling faster transaction confirmation times, ideal for point-of-sale payments.

In addition to its speed, Litecoin maintains a high 0.95 correlation score with Bitcoin based on data from IntoTheBlock’s Matrix. This means Litecoin closely tracks Bitcoin’s price movements, acting as a leveraged “sibling” crypto.

Litecoin demonstrated this by massively outperforming Bitcoin in the 2017 bull market after BTC’s halving, surging over 8,400% compared to Bitcoin’s 20x gains. Given this proven history of amplifying Bitcoin’s rallies, Litecoin seems strategically positioned to ride any bull run up again in 2024.

With Litecoin’s mining reward halving schedule even faster than Bitcoin’s, its inflation rate is dropping ahead of BTC as well. This combination of correlations, use cases, and tokenomics paints an intriguing picture for Litecoin to deliver outsized returns again following Bitcoin’s 2024 halving event.

Bitcoin Minetrix Democratizing BTC Mining Rewards

Bitcoin Minetrix offers indirect exposure to ride the expected BTC bull run wave. As Bitcoin gains value and attention during the post-halving rally, interest and activity around Bitcoin mining will likely surge as well. While major cryptos like Ethereum and Litecoin seem obvious choices, Bitcoin Minetrix (BTCMTX) offers a creative alternative way to capitalize on the event.

BTCMTX will allow holders to earn fractional “mining credit” rewards from Bitcoin’s block rewards without operating actual mining hardware. By staking BTCMTX tokens, users will gain passive exposure to Bitcoin mining income.

#CryptoCommunity, your questions, our answers…

‘Why choose #Bitcoin mining instead of buying #Bitcoin?’

Actively contribute to network expansion.

Enhanced independence in acquisition.

Gain a deep understanding of technological mechanisms. pic.twitter.com/PA63Vi93Lw

— Bitcoinminetrix (@bitcoinminetrix) January 19, 2024

With BTC scarcity increasing after the halving yet again, creative derivative assets like BTCMTX stand ready to capitalize.

BTCMTX offers exposure to Bitcoin mining profits without the overhead and rising difficulty of direct mining. With Bitcoin’s block rewards soon decreasing while transaction fees rise, BTCMTX stakers can benefit from this shifting mining income mix.

For those seeking assets outside of the major cryptocurrencies, BTCMTX staking provides a way to diversify and ride Bitcoin’s bull run after the 2024 halving event. The project’s mining rewards value proposition timed before Bitcoin’s next halving makes BTCMTX an intriguing speculative bet.

Visit Bitcoin Minetrix Here

The Significance of Bitcoin’s 2024 Halving Event

Bitcoin’s upcoming 2024 halving will be a seminal moment for the cryptocurrency market. Based on historical data, the impending supply shock has consistently catalyzed parabolic bull runs for Bitcoin’s price. But the gains have not been limited to Bitcoin alone.

Select cryptocurrencies have outperformed even Bitcoin following previous halvings thanks to their correlations, utility, and tokenomics. This basket includes smart contract leader Ethereum, speedy payments coin Litecoin, and the derivative mining rewards asset Bitcoin Minetrix. As March 2024 approaches, these standout cryptocurrencies deserve consideration to round out portfolios.

The post 3 Cryptocurrencies Set to Soar Post-2024 Bitcoin Halving appeared first on Cryptonews.