New-wave reactor technology could kick-start a nuclear renaissance — and the US is banking on it

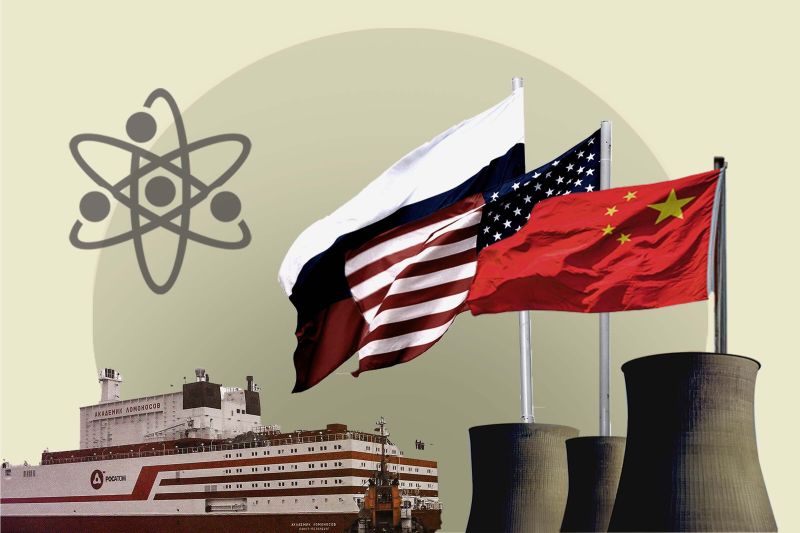

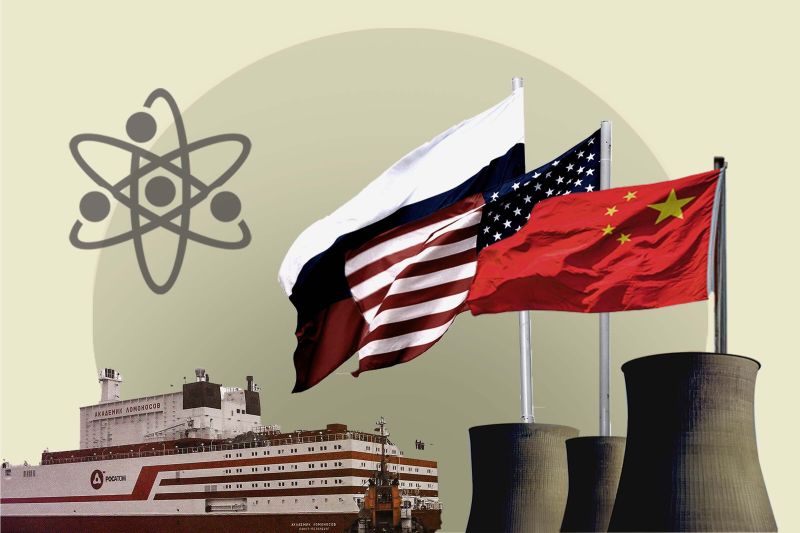

Off the Siberian coast, not far from Alaska, a Russian ship has been docked at port for four years. The Akademik Lomonosov, the world’s first floating nuclear power plant, sends energy to around 200,000 people on land using next-wave nuclear technology: small modular reactors.

This technology is also being used below sea level. Dozens of US submarines lurking in the depths of the world’s oceans are propelled by SMRs, as the compact reactors are known.

SMRs — which are smaller and less costly to build than traditional, large-scale reactors — are fast becoming the next great hope for a nuclear renaissance as the world scrambles to cut fossil fuels. And the US, Russia and China are battling for dominance to build and sell them.

The Biden administration and American companies are plowing billions of dollars into SMRs in a bid for business and global influence. China is leading in nuclear technology and construction, and Russia is making almost all the world’s SMR fuel. The US is playing catch-up on both.

There’s no mystery behind why the US wants in on the market. It already lost the wind and solar energy race to China, which now provides most of the world’s solar panels and wind turbines. The big problem: The US hasn’t managed to get an SMR working commercially on land.

SMRs are potentially an enormous global market that could bring money and jobs to the US, which is trying to sell entire fleets of reactors to countries, rather than the bespoke, large-scale power plants that notoriously go over budget and way past deadline.

While SMRs provide less energy — typically a third of a traditional plant — they require less space and can be built in more places. They are made up of small parts that can be easily delivered and assembled on site, like a nuclear plant flatpack.

Most countries are trying to rapidly decarbonize their energy systems to address the climate crisis. Wind and solar now provide at least 12% of the world’s power, and in some places, like the European Union, they provide more than fossil fuels. But there’s an increasing sense of urgency to clean up our energy systems as extreme weather events wreak havoc on the planet and as challenges with renewables remain.

For some experts, nuclear energy — in all forms, large or small — has an important role to play in that transition. The International Energy Agency, which outlined what many experts say is the world’s most realistic plan to decarbonize, sees a need to more than double nuclear energy by 2050.

“There’s definitely a huge race on,” said Josh Freed, who leads the Climate and Energy Program at the think tank Third Way. “China and Russia have more agreements to build all sorts of reactors overseas than the US does. That’s what the US needs to catch up on.”

US targets Russia’s and China’s neighbors

The US is trying to sell SMR technology to countries that have never used nuclear power in their histories. To convince them that SMRs are a good option, they’ll need to pitch hard on safety.

Globally, the construction of conventional nuclear power plants dipped following the Chernobyl meltdown in 1986, and fell again after Japan’s Fukushima disaster in 2011, data from the World Nuclear Industry Status Report shows. They started to tick up soon after, but new projects were heavily concentrated in China.

Most of the world has been cold on nuclear for the past decade or so.

But a nuclear renaissance is coming, the IEA says. The organization predicts nuclear power generation globally will reach an all-time high in 2025. That’s because several traditional nuclear plants in Japan that were put on pause after Fukushima will soon be restarted, and new reactors in China, India, South Korea and Europe will start operating.

It seems that decades-old fears over the safety of nuclear are starting to fade, and people — or their governments at least — are weighing the benefits against the risks, including the problem of storing radioactive waste, which can remain dangerous for thousands of years. That could create a more hospitable market for countries looking to export SMRs.

If SMRs help boost the popularity of nuclear energy, they could become a powerful way to address climate change. Nuclear power, generally, doesn’t emit planet-warming carbon pollution when used and generates more energy per square meter of land use than any fossil fuel or renewable, according to an analysis by Our World in Data.

At the COP28 climate talks in Dubai in December, the US led a pledge to triple the world’s nuclear energy capacity, which 25 nations have now signed onto. And the US government has earmarked $72 million to its international SMR program, known as FIRST, to provide countries with a whole suite of tools — from workshops to engineering and feasibility studies — to provide them with everything they need to buy an SMR fleet made in America.

But bigger money is coming in the form of loans from state financial institutions, like the US Export-Import Bank and its International Development Finance Corporation, which have offered up $3 billion and $1 billion, respectively. Those have gone to two SMRs in Poland designed by GE Hitachi Nuclear Energy, a US-Japanese partnership headquartered in North Carolina.

The US and American companies are also finding success in Southeast Asia — a region where many countries are seeking to loosen their ties with China — as well as central and eastern Europe, where some nations that depend on Russian gas are trying to cut their reliance on Vladimir Putin’s increasingly hostile nation.

These efforts could threaten Russia’s ambitions abroad. Russia has already built or designed nuclear plants — the traditional type — for China, India, Bangladesh, Turkey, Slovakia, Egypt and Iran. Russia is also courting countries with the Akademik Lomonosov in Siberia: The CEO of Russia’s state-owned nuclear company said last year that dozens of countries had expressed interest in Russian-made floating SMRs.

Russia has another edge: its state nuclear company supplies almost all the world’s demand for SMR fuel — enriched uranium known as HALEU.

But the US and UK, among others, are investing in their own fuel production at home. That’s essential — two SMR demonstration projects, one by X-energy in Texas and another by Bill Gates’ TerraPower in Wyoming, were awarded government support to get up and running by 2028. They will need fuel to do so.

China isn’t building many nuclear plants abroad but as the only country to have an SMR in operation on land, it’s in a good position to win a large share of the market.

It’s very difficult for American nuclear energy companies to compete with those from countries like Russia and China, which have state-run utilities that don’t have to prove their power is economical.

“Our nuclear vendors are competing against cheap, natural gas in the US,” said Kirsten Cutler, a Senior Strategist for Nuclear Energy Innovation at the US State Department. “Abroad, they’re competing against authoritarian-backed entities who are throwing in a lot of political pressure and package deals.”

But Cutler points out that nuclear deals create decades-long relationships with other countries that require trust and benefit from stability.

“Who are you going to have that relationship with? Countries recognize the risks of working with authoritarian-backed suppliers and seek partners that will strengthen their independence and their energy security,” Cutler said. “These are not trivial decisions. They’re really important 50 to 100-year decisions, and they seek the United States.”

Flexing diplomatic muscle

If the US intends to prove it can deliver an SMR, it’s not unreasonable to expect the technology to be economically viable — something the country is struggling to show.

In 2020, Oregon-based NuScale’s SMR design was the first in the country to win regulatory approval. But it announced in November 2023 it was pulling the plug on an Idaho-based demonstration project that could have ushered in the next wave of SMRs. Its costs had nearly doubled, which meant the project wouldn’t have been able to generate power at a price people would pay.

Much like large-scale nuclear plants, NuScale’s primary issue was high costs, as already expensive building supplies converged with tight supply chains, inflation and high interest rates.

It was a major blow to the argument that SMRs would be cheaper and faster to build than traditional reactors.

“It certainly dampens the excitement abroad,” said John Parsons, a senior lecturer at MIT and a financial economist focused on nuclear energy. “It makes a big difference in the marketing if the US is out there making it happen. Then people who are interested in nuclear have an easier case in their country.”

In a November statement, NuScale expressed confidence it could keep and find other customers for its power domestically and abroad.

The US is trying to flex its muscle in diplomatic circles to win this race, too.

US climate envoy John Kerry was among the most vocal supporters of nuclear energy at the COP28 climate summit. And according to an analysis by climate consultancy InfluenceMap, the US was the only foreign country to lobby the European Union to include nuclear power in its official list of energy sources the bloc considers “green,” and therefore eligible for central funding. The State Department said it does not comment on diplomatic activities when asked to confirm its lobbying.

While the US nuclear industry struggles with budgets and timelines, its rigorous approach to projects may have some payoff.

European allies, for example, trust the US’ Nuclear Regulatory Commission, particularly on safety standards, the Third Way’s Freed said. If an SMR is licensed by the NRC and built in the US, then it “gets the gold seal” of approval from other countries, he added.

But if the US wants to really make nuclear energy from SMRs more economically viable, it will have to take a look at its fossil fuel production.

“The target here is to produce electricity cheaper than coal and gas plants,” Parsons said. These fossil fuel plants are “terribly simple and cheap to run — they’re just dirty,” he added.

Even if there can be a dramatic takeoff in the US’ SMR industry, it will still take years to scale up. It will probably take until the end of this decade to even glean whether it’s viable, said Mohammed Hamdaoui, vice president of renewables and power at research firm Rystad Energy.

And that’s a problem — the scientific consensus is that the world needs to make deep sustained cuts to carbon pollution this decade to ward off catastrophic climate change.

“I don’t see it being a big player in the energy mix until the second part of the next decade,” Hamdaoui said. “It’s going to take time.”

Correction: A previous version of this story misidentified where X-energy intends to demonstrate its SMR. It is Texas. This story has been updated.