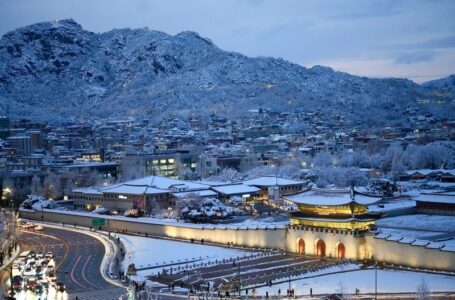

Delight and disruption as record November snowfall hits Seoul

Bitcoin (BTC) Dips Briefly Below $69,000 Before Dip-Buying Bulls Bouy Price Back to $70,500

Source: Midjourney

The Bitcoin (BTC) price dipped as low as $68,500 on Thursday amid profit-taking, before dip-buying bulls buoyed the price back to $70,500.

Bitcoin hit fresh all-time highs in the $73,800s around the time of Thursday’s European open.

At its latest price of close to $70,500, it is trading 3.5% lower on the day.

Hotter-than-expected US PPI inflation data, which come on the heels of higher-than-expected CPI numbers earlier in the week, were cited as weighing on sentiment as the US dollar and US bond yields rose.

Despite the latest drop, the Bitcoin price is still up nearly 60% so far this year. Powering the upside has been incessant spot Bitcoin ETF buying from US investors.

Can the Bitcoin price hit $100,000 before April’s halving? Source: TradingView

Net ETF inflows were $700 million on Wednesday after hitting a new record high above $1 billion on Tuesday.

Another one.

The Bitcoin spot ETFs saw nearly $700 million in net inflow yesterday. pic.twitter.com/LNw7JQXjde

— Mads Eberhardt (@MadsEberhardt) March 14, 2024

But the approval of spot Bitcoin ETFs in mid-January has facilitated the build-up of significant froth in the BTC market.

Funding rates to open leveraged futures positions have been elevated since late February, suggesting strong bullish sentiment.

Meanwhile, open interest in the Bitcoin futures market has vaulted up from around $22 billion to nearly $35 billion since the 24th of February, a 60% jump during which time the Bitcoin price has rallied 36%.

That, coupled with surging funding rates, suggests a sudden surge in bullish speculator participation in the market, leaving the market vulnerable to leverage flushouts.

Despite the sudden price drop, carnage in the futures market has remained limited for now.

As per coinglass.com, only just over $100 million in leveraged long positions were wiped out on Thursday.

That suggests plenty of bullish leverage remains, suggesting the risk of a continued price drop remains.

Dip Buying Bulls Bouy the Bitcoin Price

Despite the latest Bitcoin price dip, most market participants remain optimistic that the cryptocurrency will continue trending higher.

Psuedoanonymous X user @invest_answers noted the pattern of BTC dips being short-lived over the past week.

Like Clockwork – when the ETF’s Buy #Bitcoin. Spot the Pattern? Happening since Jan 12th pic.twitter.com/h6MyJAh98s

— InvestAnswers (@invest_answers) March 14, 2024

As per social media murmurings, BlackRock’s spot Bitcoin ETF IBIT may have just broken its daily trading volumes once again on Thursday, seeing $3.8 billion in shares change hands.

Blackrock just broke their #Bitcoin ETF volume record again with $3.8B today

— Mohegan ₿TC (@MoheganBTC) March 14, 2024

As most analysts agree, so long as net inflows into spot Bitcoin ETFs remain positive, a prolonged downtrend in the Bitcoin price looks unlikely.

Just as happened on Thursday when BTC hit $68,500, dip-buying bulls look set to continue buoying the price.

There remains an outside chance that Bitcoin can pump to $100,000 ahead of April’s halving.

Even if $73/74K did mark a short-term pre-halving top for Bitcoin, a prolonged market reversal seems unlikely.

@JRNYcrypto reminded their followers that BTC price corrections of as much as 38% are common during Bitcoin bull markets.

Don’t forget that corrections on the way up are normal and healthy. The longer you go without one, the bigger the correction will likely be

Bitcoin Halving and Ethereum Spot ETF approvals are the next big events. Very possible we get a correction and move sideways for a few… pic.twitter.com/K4P5sziCg0

— JRNY Crypto (@JRNYcrypto) March 14, 2024

“We may also get some bullish news in April of different companies… that bought in during Q1”, they added.

The post Bitcoin (BTC) Dips Briefly Below $69,000 Before Dip-Buying Bulls Bouy Price Back to $70,500 appeared first on Cryptonews.