Binance Appoints Board of Directors for First Time in Effort to Rebuild Reputation Following Legal Troubles

Binance has named a board of directors for the first time in an effort to reshape its image following last year’s guilty plea to US charges of anti-money laundering and sanctions violations.

Gabriel Abed, former ambassador of Barbados to the United Arab Emirates, has been appointed as the chairman of the seven-member board, according to a report by Bloomberg.

The remaining board members include Chief Executive Officer Richard Teng, along with three other company executives, namely Heina Chen, Jinkai He, and Lilai Wang.

The two outside members are Arnaud Ventura, managing partner at investment firm Gojo & Co, and Bayview Acquisition Corp. CEO Xin Wang.

These appointments became effective on March 7.

Founding Members of Binance Included in Board of Directors

Chen, He, and Wang are among the earliest employees at Binance and are recognized as founding team members of the crypto exchange.

Chen currently holds a senior executive position and is a co-founder of Binance, while Wang is responsible for Binance’s technology development.

He has played a crucial role in leading various key units at Binance, including fiat for on- and off-ramps.

While the appointment of the board is considered a significant change for Binance under the leadership of CEO Richard Teng, who took over in November after the company’s settlement with US authorities, industry experts have expressed some reservations.

Binance has formed a board of directors, which includes Guangying “Heina” Chen, who Binance told me was an obscure admin employee and later elevated to co-founder. Legal filings have since shown that Chen controlled many of Binance’s bank accounts.https://t.co/P2q4c9Cr0j pic.twitter.com/YD60I2qp64

— Jacob Silverman (@SilvermanJacob) April 2, 2024

Austin Campbell, an adjunct professor at Columbia Business School and a consultant for blockchain firms, told Bloomberg that the board composition, primarily consisting of company insiders, suggests resistance to outside control and oversight.

Campbell believes that the lack of independent board members with deep regulated financial risk or compliance experience is not ideal.

However, he acknowledges that having a board in place is a positive step and hopes that it will effectively guide the company moving forward.

Binance Seeks to Adopt Corporate Structure

Establishing a board and appointing a chairman are among the first steps Binance has taken to adopt a more conventional corporate structure after years of operating without a headquarters.

The company agreed to pay $4.3 billion in February as part of a plea deal approved by a US judge.

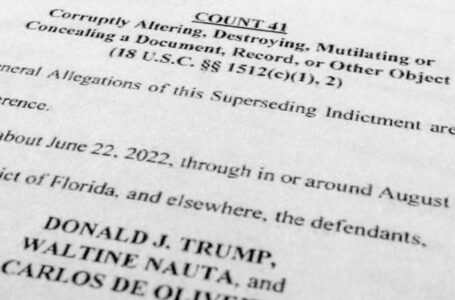

Binance’s founder, Changpeng Zhao, also pleaded guilty to anti-money laundering and sanctions violations and is awaiting sentencing in April.

Last month, a group of investors who sought to sue the exchange, its former CEO Changpeng Zhao, and other executives were given a fresh chance to pursue their case.

The headache for Binance came as the exchange recently had to discontinue all services involving Nigerian local fiat currency, the Nigerian naira (NGN), after regulatory scrutiny.

Earlier, the Nigerian government imposed a staggering $10 billion fine on Binance as part of a crackdown on the platform in an effort to stabilize the nation’s local currency.

The Nigerian government’s actions against Binance and other crypto firms stem from concerns over continuous manipulation of the forex market and illicit movement of funds.

The post Binance Appoints Board of Directors for First Time in Effort to Rebuild Reputation Following Legal Troubles appeared first on Cryptonews.