Bitcoin ETF Essential Facts: Prices, Winners, Losers, Tickers and Fees

BlackRock’s iShares Bitcoin Trust took an early lead in trading volume as 11 spot bitcoin ETFs open their doors to the investing public. The nine trillion dollar asset manager attracted trading volume of $17.9 million in the first hour.

Close behind it was ‘crypto native’ asset manager Grayscale, which was allowed to convert its closed-ended trust into an ETF. It was the court case Grayscale brought against the US Securities and Exchange Commission to contest the regulator’s refusal to allow it to convert, that arguably got the party started.

The Grayscale Bitcoin Trust already has $28 billion in assets under management, so the converted vehicle had an enviable headstart on its new competitors, ringing up early volumes of $16.7 million.

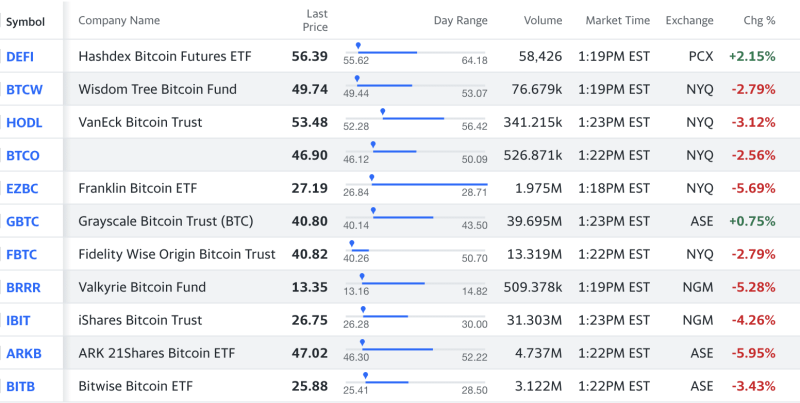

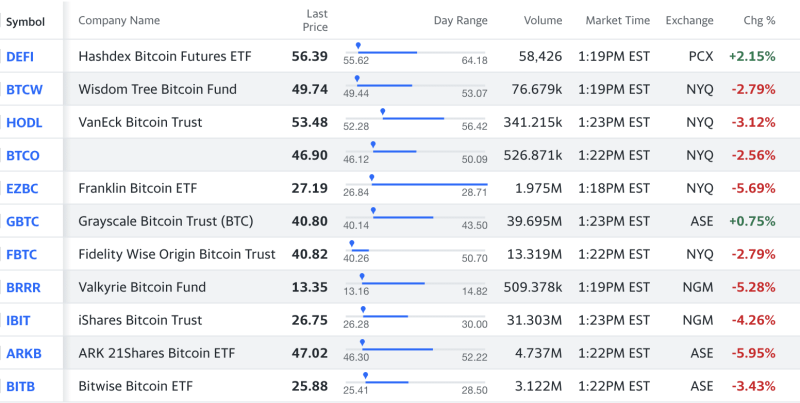

Losers were to be found among the smaller players, as was perhaps to be expected. At the bottom of the trading volume table for the first hour of price action was Hashdex Bitcoin Futures ETF (DEFI), only managing to attract volume of $25,864. However, the last laugh may be with the minnows.

DEFI at the time of writing is one of only two of the spot bitcoin ETFs that is currently in the green, its price up 2.5% at $56.45.

Source: Yahoo Finance

A number of issuers have waived their management fee in an attempt to grab market share, effectively reducing fees to 0%. ARK, Bitwise, Fidelity, Valkyrie and Invesco have all waived their fees for an introductory period varying between three and six months.

Other issuers, like BlackRock, have trimmed their charge to entice buyers. BlackRock’s iShares Bitcoin Trust (IBIT) is charging 0.12% for 12 months up to assets of $5 billion, after which the fee rises to 0.25%.

Early ETF buyers were warned – bitcoin is volatile

It is early days and the price of bitcoin has been volatile to say the least. The price of the leading digital asset challenged for $49k, reaching $48,922 but then gave up its gains for the day to return to the price it was consolidating at when the SEC waved its magic wand of approval, to rest back at $46,300.

Strong inflation figures that saw price rises starting to accelerate again hit the broader stock market today, although the Fed is still expected to start reducing interest rates later this year, but perhaps not as soon as some would have hoped. That slight souring in sentiment hurts risk assets like stocks and of course crypto. CPI inflation year on year came in at 3.4% compared to estimates forecasting 3.2%.

Anyone who bought into a spot bitcoin ETF in the first hour of trading is currently probably sitting on a loss, although there are a few hours to go before the bell rings. Volatility is of course the lifeblood of bitcoin, so buyer’s remorse would be misplaced, or at any rate a case of not doing your due diligence.

Bitcoin to $100,000 this year says Standard Chartered

However, those taking a longer-term view will be happy to have got in now assuming Standard Chartered’s price target of $100,000 by year-end and $200,000 in 2025 comes to pass.

Whichever way you look at launch day, it is bitcoin that is the winner. Trading volumes in the spot market are up 40%.

If you are new to crypto and researching whether the nascent digital asset class is right for you, check out our article 5 best cryptocurrencies to hold in a traditional investment portfolio.

Alternatively, those of a more speculative persuasion could try their luck with Bitcoin Minetrix, a project whose unique selling point is in bringing tokenized bitcoin cloud mining to market in a first for the industry.

The native token $BTCMTX is in presale now and has so far raised an impressive $8.2 million from contributors. Stake the token and you earn cloud mining credits entitling the owner to a proportionate share of bitcoin mining rewards.

As bitcoin BTC block reward halving draws closer and the ETF approvals are now behind us, Bitcoin Minetrix provides a novel way of gaining exposure to the bitcoin growth story as mining becomes more profitable and bitcoin more scarce and valuable.

Below we provide a breakdown of the essential information you need to navigate the spot bitcoin ETF market:

The post Bitcoin ETF Essential Facts: Prices, Winners, Losers, Tickers and Fees appeared first on Cryptonews.