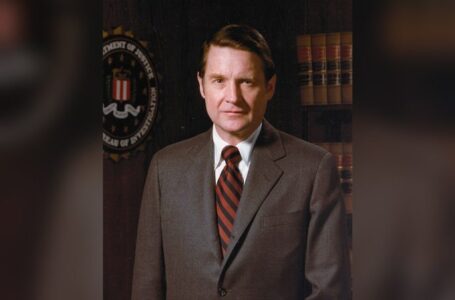

Former FBI and CIA chief urges senators to sink Patel, Gabbard

Mortgage rates cut as new year price war intensifies

<?xml encoding=”utf-8″ ?????????>

HSBC has become the first leading bank to cut mortgage rates below 4 per cent as a new year price war between lenders gathers pace.

The bank cut rates by up to 0.85 percentage points on Wednesday, releasing a five-year fixed rate at 3.94 per cent for customers coming off their existing deals. The reduction would save someone with a £200,000 25-year mortgage £96 a month — £1,152 a year — in repayments.

It also released a two-year fix at 4.49 per cent, the first time since June that a two-year deal has been available at below 4.5 per cent.

The rate cuts put the bank at the top of the best buy tables and come after Halifax and Leeds Building Society cut mortgage rates on Tuesday by up to 0.92 percentage points.

David Hollingworth from the mortgage broker L&C said: “These cuts are just the latest salvo in an increasingly fast-moving market and others will be bound to follow suit. We thought 2024 would start with a bang and that’s proving to be the case.”

Generation Home and the specialist lender Bluestone Mortgages also said on Wednesday that they would cut mortgage rates while First Direct, HSBC’s sister bank, will also make large reductions on Friday.

Many of the cuts so far this week have been particularly big because some banks did not make any reductions just before Christmas to avoid being swamped by demand from borrowers, so they need to catch up.

The cuts are also being driven by fierce competition in a mortgage market that is expected to be smaller than previous years, plus expectations that the Bank of England base rate might soon be cut from 5.25 per cent.

“The pressure is on the other leading lenders to lower rates,” Aaron Strutt from the mortgage broker Trinity Financial said. “Banks and building societies want to lend more money and they understand the negative effect these higher rates have on the property market and wider economy.

“Lenders will be working out their strategies for the year and trying to figure out how to boost their lending figures, which in many cases were shockingly low last year. Many borrowers have been holding off remortgaging or purchasing a property because of high rates, so new sub-4 per cent fixes should give them a bit more confidence to refinance or get on the property ladder.”

Some 1.6 million homeowners are due to come to the end of their fixed-rate deals this year, the trade association UK Finance said, most of whom were previously on rates of 2.5 per cent or below.

Those people still face paying more when they remortgage, but rates falling from their highs last summer when the cheapest deals were between 5.5 and 6 per cent will take out some of the sting.

Rates have steadily fallen over the last three months on the back of a sharp fall in the rate of inflation, which went from 8.7 per cent for the year to May to 3.9 per cent in November. This has been followed by widespread expectations that there will soon be a cut in Bank rate, which went from its record low of 0.1 per cent in December 2021 to 5.25 per cent in August last year as the Bank of England tried to tame inflation.

Bank policymakers, including Andrew Bailey, the governor, have stressed that it will need to remain at this level for an extended period to ensure inflation returns to the 2 per cent target. But most of the 41 economists polled by The Times expect at least two cuts to Bank rate this year because inflation has fallen faster than expected.