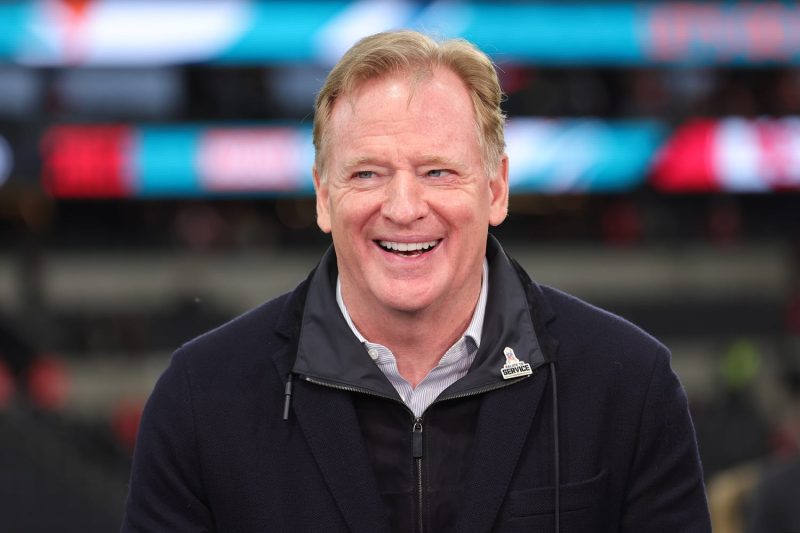

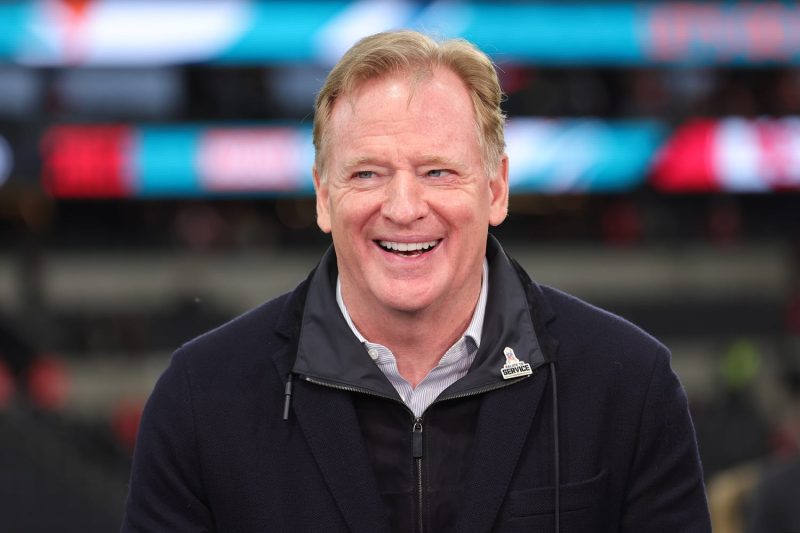

NFL open to private equity team ownership of up to 10%, Commissioner Roger Goodell says

The National Football League is considering allowing minority private equity ownership for its 32 teams of up to 10%, Commissioner Roger Goodell said in an exclusive CNBC interview Thursday.

“As sports evolve, we want to make sure our policies reflect that,” Goodell said in an interview with CNBC’s Julia Boorstin at Allen & Co.’s annual Sun Valley Conference. “We’ve had a tremendous amount of interest [from private equity firms], and we believe this could make sense for us in a limited fashion, probably no more than 10% of a team. That would be something we think could complement our ownership and support our ownership policies.”

The NFL hopes to set its new ownership policies by the end of the year, Goodell said. The 10% cap would be a starting point, and the league is open to raising it in time, he said.

While other major U.S. sports leagues, including the National Basketball Association, Major League Baseball, the National Hockey League and Major League Soccer all allow private equity ownership of up to 30%, the NFL has resisted taking money from institutional funds, such as private equity, preferring limited partners to be individuals or families.

But franchise valuations have steadily risen as the NFL has signed lucrative media deals, meaning fewer people can afford team ownership. In 2023, Josh Harris, co-founder of private equity firm Apollo Global Management, headed a group that paid $6.05 billion for the Washington Commanders — the most money ever spent on a U.S. professional sports franchise.

“Unless you’re one of the wealthiest 50 people [in the world], writing a $5 billion equity check is pretty hard for anyone,” Harris told CNBC “Squawk Box” co-anchor Andrew Ross Sorkin at the CNBC CEO Council Summit in Washington, D.C., last month.

Harris tapped 20 people to help raise money for his bid, including former NBA superstar Magic Johnson; former Google CEO Eric Schmidt; and David Blitzer, the Blackstone Group senior executive who previously partnered with Harris to buy the NBA’s Philadelphia 76ers and the NHL’s New Jersey Devils.

“Raising that amount of capital was unique; it had never been done before,” Harris said. “I think it may be leading to some rethink into the consideration of letting private equity, as an example, or institutional investors into the NFL.”

The National Women’s Soccer League allows private equity firms to take majority control of franchise teams, unlike the other U.S. professional sports leagues. Private equity incentives around reaching investment targets and exit thresholds could alter the motivations for ownership in ways that make the bigger sports leagues uncomfortable.

Minority stakes typically come with little or no decision-making power on the team. That is likely comforting to the NFL if it allows private equity investors, but it has also limited the number of individuals interested in taking smaller stakes in teams.

“These people are really rich and successful. They’re used to being the center of the universe. And now you go, I need a quarter of a billion dollars. Fantastic, what do I get? Nothing,” Ted Leonsis, the owner of the Washington Capitals, Wizards and Mystics, told ESPN in May. “Do you have any control? Any role? No, you’re passive investors. You’ll get your name on a website somewhere or something and you get to tell people I own a piece of an NFL team.”

Private equity firms, tasked with finding investment vehicles to make returns on their assets under management, may be better suited to minority ownership.