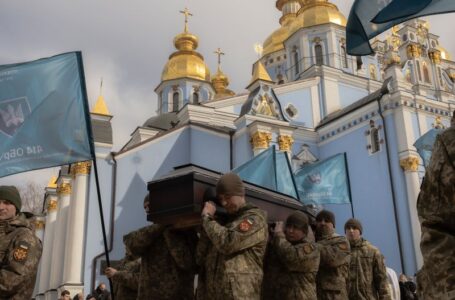

Syria clashes have killed more than 300 people since Thursday, monitoring group says

Stocks fall as comeback rally falters; Dow lower by 100 points

Stocks slipped into the red as markets closed Wednesday, losing gains from earlier in the day as Wall Street failed to recoup losses from Monday’s massive sell-off.

The Dow Jones Industrial Average fell 163 points, or 0.4%. The S&P 500 declined 0.5%, while the Nasdaq Composite dropped 0.7%.

Earlier in Wednesday’s trading session, the Dow rallied more than 300 points. The broad S&P 500 and the tech-heavy Nasdaq were also higher on the day before turning negative.

A rollover in Nvidia and other big technology stocks following an early jump led to the major averages rolling over in the afternoon. Nvidia pulled back 3.5%, while shares of Super Micro Computer tumbled more than 20% after the server company’s fiscal fourth-quarter earnings missed analyst estimates. Tesla also lost 3.4% and Meta Platforms shed 0.2%.

The benchmark 10-year Treasury yield continued its climb and rose 5 basis points to 3.94%. This marked a return to its level prior to the weak jobs numbers on Friday that raised concerns of an economic downturn.

The Cboe Volatility Index, known as Wall Street’s “fear gauge,” was last trading at 28.3 after falling to as low as 22 earlier on Wednesday. The sharp decline from near 65 on Monday indicates investors’ fears are abating, but still remain elevated from their initial levels at the start of the month.

“There’s been some reassurance over the last couple days that things have calmed down a bit. But there are still quite a few unknowns on the horizon, such as how much more unwind there is on the yen carry trade, as well as geopolitical headwinds,” said Charlie Ripley, senior investment strategist at Allianz Investment Management.

On Tuesday, the S&P 500 and the Nasdaq each advanced 1%, while the 30-stock Dow added nearly 300 points on Tuesday. On Monday, the Dow and the broad-market S&P 500 posted their worst session since 2022, fueled by recession worries and the unwinding of the yen carry trade.