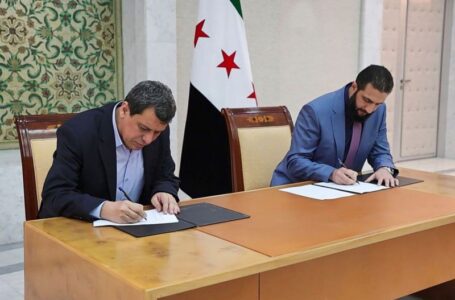

Kurdish-led Syrian Democratic Forces to merge with Syrian state institutions in landmark deal

Trillion-Dollar Asset Manager Franklin Templeton Highlights Bitcoin Ordinals’ Impact on Innovation in Recent Note

Franklin Templeton, a trillion-dollar asset manager, has recently highlighted the impact of Bitcoin Ordinals on innovation in the crypto space in a note to its investors.

In a recent note, the company’s digital assets division, Franklin Templeton Digital Assets, introduced the concept of Bitcoin-based non-fungible tokens (NFTs).

According to Franklin Templeton, the Bitcoin Ordinals protocol has played a significant role in driving positive momentum and innovation within the Bitcoin ecosystem.

The asset manager said it observed a “renaissance in activity” on Bitcoin in the past year, largely attributed to Ordinals.

Additionally, the introduction of new fungible token standards like BRC-20 and Runes, Bitcoin-based layer-2 networks, and Bitcoin decentralized finance (DeFi) primitives have further contributed to the advancement of Bitcoin innovation.

Bitcoin NFT Activities Are Growing

In the note, Franklin Templeton acknowledged the accelerating activities within the Bitcoin NFT space.

The company noted the increasing dominance of Bitcoin within the broader NFT ecosystem, particularly highlighting the surge in trading volume for Bitcoin Ordinals.

“Bitcoin Ordinals have seen a surge in trading volume over the past several months. This is reflected in an increase in dominance starting in December of 2023 when it surpassed ETH in trading volume.”

Furthermore, Franklin Templeton highlighted several Bitcoin Ordinals collections that have begun to dominate the NFT space in terms of trading volume and market capitalization.

Notable collections include NodeMonkes, Runestone, Bitcoin Puppets, Ordinal Maxi Biz, and Bitmap.

The Rise of Bitcoin Ordinals pic.twitter.com/nKLwwlMM4d

— Franklin Templeton Digital Assets (@FTI_DA) April 3, 2024

While expressing optimism about Ordinals, the asset manager emphasized the potential risks associated with these assets.

Franklin Templeton cautioned that Ordinals may experience value depreciation and lack bank guarantees.

The note also clarified that Ordinals assets are not insured by the Federal Deposit Insurance Corporation, underscoring the importance of understanding the risks involved in digital asset investments.

Franklin Templeton Resumes Crypto Push

Franklin Templeton has been actively introducing its investors to various segments within the crypto space.

In a previous investor note, the company explored the potential of memecoins to generate quick profits but also highlighted their lack of intrinsic value.

Additionally, Franklin Templeton entered the Bitcoin ETF market by launching a spot Bitcoin ETF earlier this year.

Named the Franklin Bitcoin ETF and trading under the ticker symbol EZBC, the fund is specifically designed for U.S. investors and mirrors the performance of Bitcoin.

The asset manager has also established Franklin Templeton Digital Assets, a dedicated group focused on research and technical development within the digital asset ecosystem.

“Investors continue to demonstrate interest in digital assets and express a desire for a simpler way to allocate to the asset class—one that removes the complexities associated with things like wallets and keys,” Roger Bayston, Head of Digital Assets at Franklin Templeton, said earlier this year.

“As a firm, we are well positioned to leverage our in-depth knowledge of blockchain ecosystems to introduce products like EZBC that serve to further the understanding and accessibility of digital assets within the broader investing community.”

More recently, the firm has filed for a spot Ether ETF, demonstrating its involvement in pursuing investment opportunities in the crypto asset space.

The post Trillion-Dollar Asset Manager Franklin Templeton Highlights Bitcoin Ordinals’ Impact on Innovation in Recent Note appeared first on Cryptonews.